The general accounting of a Yoga Centre registers the value of transactions made by your yoga classes and it also identifies what the Yoga Centre owns and what it owes.

The accounting will document the cash inflows and cash outflows chronologically: the cash outflows (charges, expenses…) can be deducted from the cash inflows (classes, selling of T-shirts, books…), which will give you an idea of the operating result and the net income for the year (income statement)

Another document, prepared annually, is the balance sheet. This will show a state of the financial balance of your centre (company or Independent) by repeating in detail what it owns and what it owes.

Finally, there is a set of related documents that provide details on these recorded operations.

The legal obligation of accounting

It is mandatory to have accounting in all business activities.

However, there are different types of accounting, such as:

• Simplified accounting for liberal professionals: allows exemption of issuing a balance sheet of assets and liabilities, by completing a tax form (reference from# 2035A to 2035F)

The principle of the accounting chart

The general accounting principle of a “Yoga Centre” is the principle known as “double entry.”

Transactions are reported in a table with two columns:

• Inputs: the revenues

• Outputs: the expenditures.

This makes it easier to find a particular transaction or transaction group (expense or revenue) since everything is classified by type of expense or revenue.

The accounting books

It is mandatory to maintain certain accounting books based on the (business) size of your Yoga Centre. Today, accounting software produce general reports so it is no more necessary to buy big books in paper form.

There are also other differences for liberal professionals.

Invoices

All transactions between professionals require an invoice. Moreover, if you buy equipment (e.g. yoga mats), your supplier will need to issue an invoice on behalf of your yoga centre. On the other hand, issuing an invoice is not always mandatory, for example when selling to an individual.

Mandatory information, which needs to appear on invoices

Information that must appear on your invoices :

• Name and address of the Yoga Centre.

• Registration number or commercial register

• Legal form of the business/company (EURL, SARL, SA..)

• Name and address of the client

• Invoice number

• Issuing date of the invoice

• Precise description of the provided goods or services

• Quantity sold

• Unit price excluding tax

• The amount of the VAT

• Price all taxes included

• The date on which the invoice must be paid or the granted payment period.

Where appropriate, the invoice may include:

• Discounts, reductions

• Method of payment

• Late-payment rates

• Cash payment discounts

Terms for issuing an invoice

An invoice must be issued in two copies (in electronic or paper form):

• One copy for the customer,

• The other copy for the company/business, it must be conserved for a minimum of 5 years

The customer’s copy must be immediately issued for any sale with immediate removal or immediate delivery (carpet). The invoice can be submitted later in case of a service to be provided in the future. In this case, the invoice can be given on the date of the end of the services.

However, in some cases an invoice can be issued later than the delivery date, for example when you don’t know what the exact price is or if you prefer to issue a single invoice at the end of the month for a series of services (consolidated invoice).

Invoices for a professional customer/company

It is always required to issue an invoice when selling to a professional customer/business.

Your professional customer needs a proof of the purchase in his accounting but it is also necessary in order to calculate and recover the VAT.

Invoices for a private individual

The conditions regarding the invoices for a private individual are more flexible.

Issuing an invoice is mandatory when individuals:

• Have the ability to recover VAT, in the case of intra-Community sales with a country exempt from VAT,

• Remote purchasing

- If requested by the private individual, you cannot refuse.

- Association for their own space accounting

- Professor of Yoga, to deduct their business expenses.

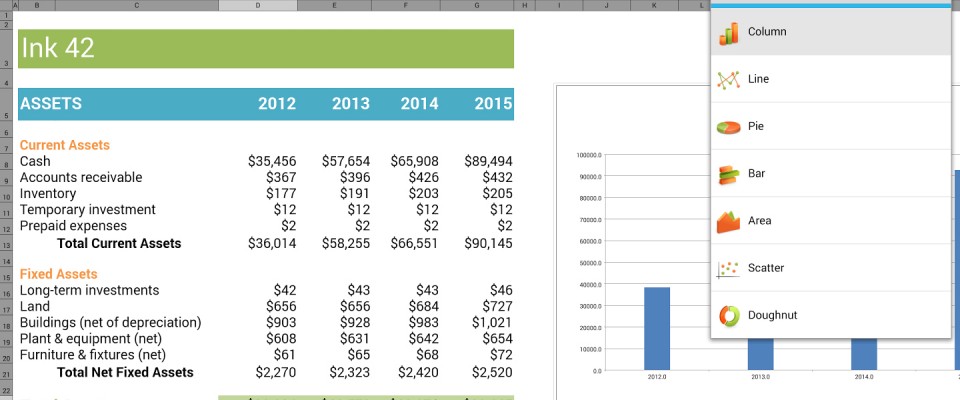

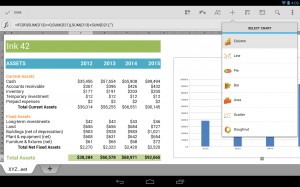

Download a sample sheet accountant :

- Card received : course, session, etc. _EN